潮新闻客户端 记者 鲁佳

2023年初,工信部发布《“机器人+”应用行动实施方案》,其明确表示在制造业领域,“推进智能制造示范工厂建设,打造工业机器人典型应用场景。发展基于工业机器人的智能制造系统,助力制造业数字化转型、智能化变革”。

从“制造”到“智造”的关键基础设施

在新一轮技术革命和产业变革的时代背景下,全球各主要经济体积极围绕以工业机器人为主的智能制造业展开激烈竞争。作为打造从“制造”到“智造”的关键基础设施,工业机器人扮演者愈加重要的角色。

工业机器人是广泛用于工业领域的多关节机械手或多自由度的机器装置,具有一定的自动性,可依靠自身的动力能源和控制能力实现各种工业加工制造功能。工业机器人被广泛应用于电子、物流、化工等各个工业领域之中。一般来说,工业机器人由三大部分六个子系统组成。三大部分是机械部分、传感部分和控制部分。六个子系统可分为机械结构系统、驱动系统、感知系统、机器人-环境交互系统、人机交互系统和控制系统。

随着机器人技术的不断发展,以数字化、网络化、智能化为核心特征的智能制造模式,正在成为产业发展和变革的重要方向。相比于传统的工业设备,工业机器人有众多的优势,比如机器人具有易用性、智能化水平高、生产效率及安全性高、易于管理且经济效益显著等特点,使得它们可以在高危环境下进行作业。发展工业机器人,不仅可提高产品的质量与数量,而且对保障人身安全、改善劳动环境、减轻劳动强度、提高劳动生产率、节约材料消耗以及降低生产成本都有着十分重要的意义。

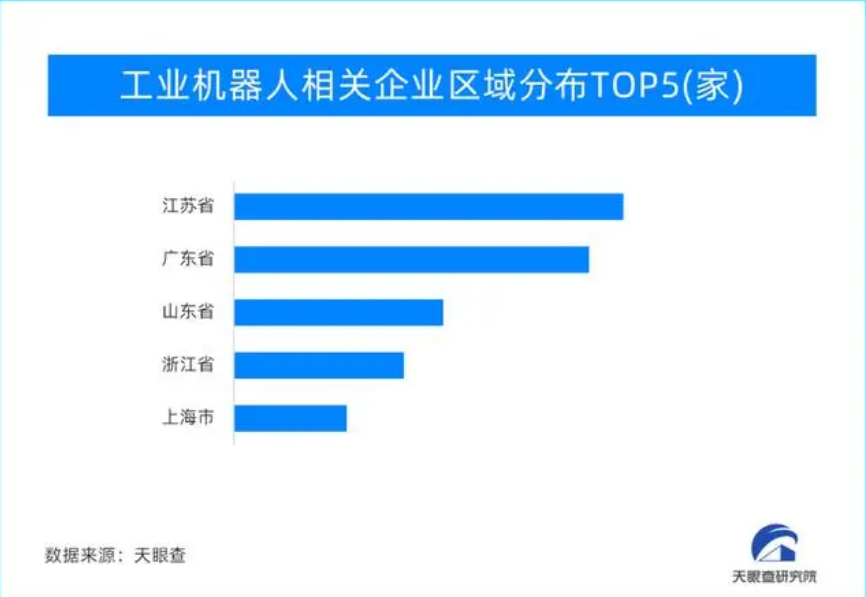

天眼查数据显示,现存工业机器人相关企业23.1万余家,其中2023年1-10月新增注册相关企业2.2万余家;

从地域分布来看,江苏以4.2万余家相关企业在各省份中“领跑”,广东以及山东紧随其后,分别拥有3.8万余家、2.3万余家相关企业。

从成立时间来看,52.8%的工业机器人相关企业成立于1-5年内,成立在1年以内的占比约为27.2%。

工业机器人产业链环节:核心零部件占比较高 技术壁垒更高

工业机器人产业链主要由原材料、零部件(上游)、机器人本体(中游)、系统集成(下游)以及行业应用等几个环节组成。工业机器人的生产成本结构中,上游核心零部件占比较高,伺服系统、控制器与减速器成本占比超70%,这其中减速器则占到一半,而本体制造仅占15%。究其原因,工业机器人的驱动与控制功能均来自核心零部件,与本体制造相比,核心零部件的技术壁垒更高,因此生产成本占比高。

上游:核心零部件占比较高,生产成本较高

上游零部件环节主要包括:控制器、伺服电机、减速器以及执行系统等。其中,控制器、伺服电机和减速器是生产工业机器人的关键零部件,也是国内外工业机器人着力打造的核心竞争力之所在。就开发的难易程度而言,控制器是工业机器人开发的配套设备,开发难度中等;伺服电机是工业机器人的核心驱动机构,开发难度中上;减速器是封闭在工业机器人刚性壳体内的齿轮传动、蜗杆传动、齿轮-蜗杆传动所组成的独立部件,开发难度最高。

中游:机器人本体

工业机器人本体生产商主要负责组装和集成工业机器人本体。目前内资品牌机器人销售占比不断上升。根据机经网数据,2015年到2020年中国机器人本体市场的内资占比由18.6%提升至28.6%,2021年内资占比进一步升高,为33.7%。目前内资工业机器人本体生厂商主要集中于中低端市场,高端应用市场仍被发那科、库卡、ABB、安川四家外资企业占据。高端市场被“四大家族”垄断,国产品牌埃斯顿向龙头靠拢。根据MIR Databank统计的中国工业机器人出货量数据,2021年“四大家族”合计共占据市场份额的41.5%,分别为发那科(13%)、ABB(12.3%)、安川(8.8%)、库卡(7.4%)。国产龙头埃斯顿市场份额为2.4%,排名第十一位,汇川与新时达等内资品牌也排名靠前。

下游:机器人集成系统

工业机器人系统集成商处于产业链的下游应用端,根据不同的场景与用途,负责对工业机器人本体进行针对性的系统集成和软件二次开发,使其拥有特定的工作能力。

工业机器人应用领域:自动化生产、汽车制造、物流等领域广泛应用

机器人市场应用加速拓展,2022年工业机器人装机量占全球比重超过50%,稳居全球第一大市场,制造业机器人密度达到每万名工人392台。工业机器人被广泛应用在自动化生产、汽车制造、物流、医疗、3c电子等领域。

自动化生产。在自动化生产领域中,工业机器人是一种非常重要的设备。它可以进行重复、繁琐、危险或高精度的工作,让传统的劳动力解放出手来学习更具有创新性的工作。在生产线上,工业机器人可以自主地进行零件装配、检测和包装等任务,增加了企业的生产效率。此外,工业机器人的可编程性和高精度控制技术,还能够快速适应不断变化的生产需求,实现批量或小批量生产的快速转换。

汽车制造。在汽车制造行业,工业机器人在汽车制造业中有着广泛的应用。在汽车制造过程中,工业机器人可以承担焊接、喷漆、装配和点胶等各种任务,从而提高生产线的效率以及提高产品质量。而且在汽车零部件制造中,工业机器人也可以用于模具铸造、铣削和钳制等多种工艺过程中,提高了生产效率和良品率。

物流。在物流行业中,工业机器人在物流行业中的应用也越来越广泛。它可以用于处理和分拣货物、仓储管理和运输等多个环节,提高了物流的效率和安全性。工业机器人也可以帮助企业减少人员成本,并降低操作风险。

3C电子。在3C电子行业中,工业机器人已被广泛应用于手机等电子产品的制造和包装。它们以高度灵活的方式移动和操作,可以精确地执行复杂的组装任务,为生产线的高效自动化提供了关键支持。工业机器人可以提高生产效率。它们能够自动化完成重复性工作,不仅能够提高制造速度,还能够减少人工错误。此外,机器人系统的高精度执行能力可以确保生产出的产品精度和质量符合要求,从而有效地避免了人工操作错误对产品品质带来的不良影响。

医疗。在医疗行业中,工业机器人在医疗领域也有着许多的应用,它可以用于进行手术、治疗和康复等多种工作,提高了工作的精度和安全性。此外,工业机器人还可以帮助医院解决医护人员不足的问题,为病人提供更多样化的康复治疗方案。

投融资分析:江苏、上海、广东三地融资事件数量位居前列

中国庞大的制造业体量孕育出全球最大的工业机器人市场,自 2013年以来,中国已多年占据着全球最大工业机器人消费市场。工业机器人作为智能制造领域的“明珠”,也是持续受到风险投资机构的关注。

从融资事件的行业分布来看,机器人本体相关的融资事件数量位居前列,拥有60起;除此之外,智能装备、物流装备、仓储服务等于工业机器人密切相关的下游应用领域也是投融资热点。

从融资事件的地域分布来,省/直辖市一级来看,江苏、上海、广东三地融资事件数量位居前列,分别有16起(江苏、上海并列)以及15起;从市一级来看,深圳、南京以及合肥所拥有的融资事件数量靠前,分别有11起、10起以及4起。从融资事件的地域分布可明显看出工业机器人与制造业强省的关系也是非常紧密,有力支持了制造业升级。

从融资事件的轮次分布来看,战略融资、A轮、B轮位居前列,分别有14起、12起以及11起。

从投融资机构“出手”情况来看,蓝驰创投、道生资本以及联想创投等机构均榜上有名;除机构之外,产业资本诸如:比亚迪、海尔、科沃斯等知名企业也出现了环动科技、天创机器人等企业的投资人名单中。

专利分析:2023年1月迄今为止,已有1400余项的专利申请

工业机器人作为技术密集型产业,专利技术的申请数量从侧面显现出产业发展的科技含量与技术水平。

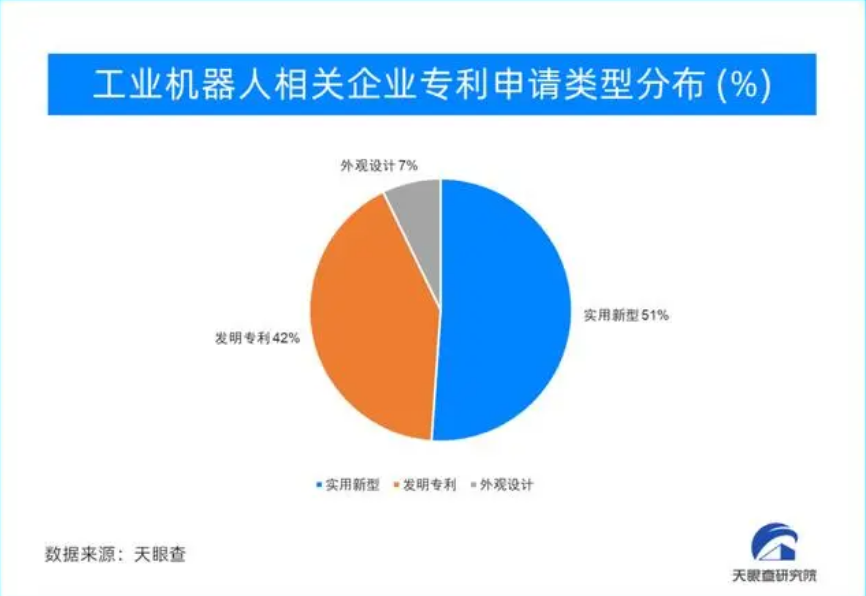

从工业机器人专利申请总量来看,申请专利数量已超万项,其中,实用新型以6200余项位列第一,发明专利5100余项位列第二,外观设计以880余项位居第三。

从专利申请的年度分布来看,从近三年(2020-2022)专利申请量逐年上升,从1500余项到2100余项,有了大幅的提升。另外,2023年1月迄今为止,已有1400余项的专利申请。

六、发展前景:性能提升和价格下降 国产替代前景广阔

国产机器人性能提升、价格下降,经济效应显著。根据国家统计局数据,工业机器人产品的进口均价由2019年的16.23万/台逐渐下降至2022年的8.52万/台,一般情况下国产机器人的价格低于进口机器人。随着性能提升和价格下降,工业机器人应用的经济效应更加显著,将有助于工业机器人行业拓宽应用场景、扩大下游需求。

产业升级和国产替代描绘广阔前景。一方面源于产业升级。我国经济正处在转变发展方式、优化经济结构、转换增长动力的攻关期,迫切要求劳动密集型产业转型升级。产业升级将带动大量工业机器人市场需求。另一方面,国家提出了工业机器人的国产化目标。《中国制造2025》设定了国产工业机器人发展的目标,对国产机器人和关键零部件的国产化率均提出明确要求;《“十四五”机器人产业发展规划》明确,我国“到2025年,一批机器人核心技术和高端产品取得突破,整机综合指标达到国际先进水平,关键零部件性能和可靠性达到国际同类产品水平。”国产工业机器人凭借迅速突破的产品性能、更具优势的性价比和服务水平,逐步提升市场份额。

机器人出海将成为未来发展的重要方向。国内工业机器人的性能短板正在逐渐补齐,随着国内制造业“走出去”以及全球制造业向东南亚、拉美的转移,机器人出海将成为未来发展的重要方向。

天眼查研究院认为,在数字经济的引领之下,在数实融合的背景之下,大力发展工业机器人产业,有效推进中国制造业结构转型升级,有助于持续增强和保持中国制造在国际市场的竞争力。

注:本次所分析工业机器人领域投融资事件是以2023年1月-11月12日为参考